-

- Global

- Algeria, Djazair

- Angola

- Argentina

- Australia

- Belgium

- Brazil

- Chile

- China

- Cyprus

- Dominicana

- Ecuador

- Egypt

- EU Intermodal

- Hong Kong

- India

- Indonesia

- Malaysia

- Mozambique

- New Zealand

- Pakistan

- Peru

- Philippines

- Romania

- Rwanda

- Saudi Arabia

- Senegal

- Serbia

- Singapore

- Somaliland

- South Korea

- Spain

- Suriname

- Thailand

- Turkiye

- United Arab Emirates

- Ukraine

- United Kingdom

- Vietnam

-

Menu

-

SOLUTIONS

Related content

![relatedcontent]()

Data Fills The Gaps In Modern Supply Chains

Global supply chains are no strangers to disruption, whether caused by trade disputes, geopolitics or the unpredictable forces of climate change. Amidst these challenges, an often-overlooked vulnerability lies in supply chain data gaps.

Read more![relatedcontent]()

Rail Networks Transform Supply Chains

Rail freight has the potential to revolutionise supply chains in both developed and developing nations, providing a key role in promoting sustainability and economic growth.

Read more -

INDUSTRIES

Related content

![relatedcontent]()

Making Healthcare Equity Reality

Healthy societies transform economies, yet the pandemics of the past few years have demonstrated that healthcare logistics is a complex beast and unique to that of any other sector.

Read more![relatedcontent]()

The Future Of EVs Is In Our Supply Chains

Electric vehicles (EVs) are proving to be the most popular replacement for fossil fuel cars. So much so that by 2030 electric vehicles will represent over 60% of vehicles sold globally.

Read more -

INSIGHTS

Related content

![relatedcontent]()

Our Stories

We connect people, markets and nations to change what's possible for everyone.

Read More -

SUSTAINABILITY

Related content

![relatedcontent]()

Changing the perception of water

Water is crucial for life on Earth and vital for our well-being. Businesses, including ours, can play a significant role in changing how water is used.

Read more![relatedcontent]()

Climate proofing the supply chain

We examine three climate scenarios, assessing the potential impact of weather hazards across 50 ports and terminals in our global portfolio.

Read more

- SOLUTIONS nav

- INDUSTRIES nav

- INSIGHTS nav

- SUSTAINABILITY nav

The Top 5 Automotive Industry Trends Coming Our Way

On the horizon for 2023

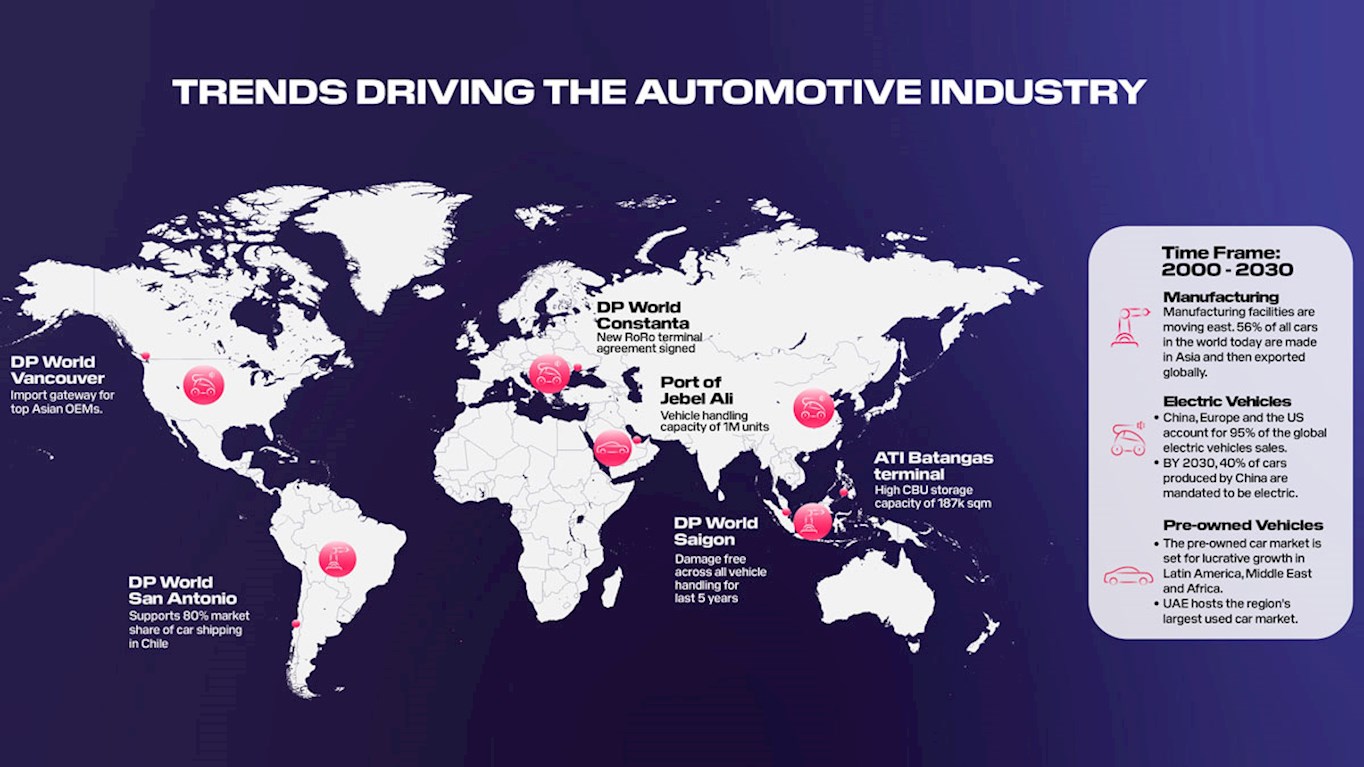

As leaders in the automotive import and export market – from parts to finished models – we have a close-up perspective on the automotive industry globally at DP World. Our end-to-end view of the world’s supply chains gives us a unique insight into industry trends.

Here is what we see as being on the horizon for 2023.

Manufacturing will continue moving East

Throughout our vast experience of handling Asian cargo, we have witnessed car manufacturing boom in China specifically and decline elsewhere. With the rise in fuel prices, chip shortages, and the ongoing energy crisis, along with the scale of Chinese investment in electric vehicle (EV) technology, manufacturers have been moving production facilities to Asia.

As it stands, China is the only export market that can satisfy growing demand. China manufactures 21.4 million passenger cars per year, far outstripping other top car producing countries. While most competitors are Asian, the closest non-Asian country is Germany at 3.1million passenger cars per year. The entire Asian region sets itself apart from the rest of the world with an insatiable drive for innovation.

Logistic networks are the fundamental component for growth in all things automotive

The China success story is about scale, efficiency, value and logistics. Many of the China’s manufacturers are multipurpose, making individual components as well as the finished vehicle, and then exporting these products around the world. Nearly all car parts are manufactured en-masse somewhere within the country.

The logistics network in China is key to its ongoing growth, supported by state-of-the-art ports that have quickly adapted to the growing number of vehicles being shipped from Asia to satisfy global demand.

As a result, more sophisticated, technologically advanced car-handling terminals are needed everywhere. With car manufacture market share on the decline throughout Europe, and North America’s market remaining largely domestic, building a supply chain infrastructure that can facilitate Asia’s automotive manufacturing industry has become a global imperative.

New opportunities for regional manufacturing

The rise of the Asian automotive industry isn’t a total monolith. Political turmoil is changing the world of trade and we are seeing some movement towards regionalized manufacturing as a result. Countries would rather source manufacturing closer to home to keep customers happy rather than risk costly supply chain disruption.

For the automotive industry’s current structure, this is a difficult factor to navigate given that Asia dominates parts and car manufacture. But as port operators, we are planning to act as a facilitator to appease both sides of this debate. That comes in the form of opening car manufacturing outposts at ports. Especially in response to the growing demand for EVs.

Despite manufacturing bottlenecks, a steady rise in the production of EVs

EVs are estimated to account for 17% of all automotive trade by 2030. And while there is a concerted push to make the switch due to the urgency of the climate crisis, EV roll-out on a consumer level is still slow in relation to demand, largely due to production and cost issues.

That said, the world’s ports and terminals will be playing a fundamental part in boosting EV uptake. Through more streamlined supply chains and by adapting terminal automotive capabilities, we can make EVs more accessible – and more affordable – for more people in the long run.

Increased sales of pre-owned vehicles in emerging markets

Affordability and advanced recharging infrastructure means EV uptake is highest for wealthy economies. But while these vehicles remain at a premium, there’s a growing need for second-hand fossil fuel vehicles in developing areas.

As a result, the used car market is set for lucrative growth in Latin America, the Middle East and Africa. The Middle East and Africa Used Car Market, for instance, is expected to reach US$32.20 billion by 2027, (up from $18.20 billion in 2021).

With many Chinese automotive manufacturers targeting expansion in places like South America, DP World’s ports are offering manufacturers reliable, fast and cost-effective routes to this vital market. In just one example, our two Chilean ports are currently handling a combined total of 444,000 vehicles each year.

Shipping options are critical to expansion

The question is, can the shipping industry keep up with this changing automotive demand? A third of car manufacturers (32%) rank lack of available shipping capacity as their most pressing logistics challenge.

Across diverse geographies and cultures, new logistics infrastructure and access points have provided a basis for building smarter trade that works in tandem with manufacturers across the world. That will only continue developing in exciting ways throughout 2023 as we grow alongside the automotive industry.

We use cookies on this site to enhance your user experience. By continuing to visit this site you agree to our use of cookies. Learn More